Creating a budget that genuinely works for you is not just about tracking expenses—it’s about building a financial roadmap that reflects your goals, values, and lifestyle. In 2025, with inflation rates fluctuating and living costs rising in many parts of the world, personal finance management has become more critical than ever. A well-crafted budget can help you gain control over your money, avoid unnecessary debt, and create a clear path toward financial freedom. Whether you’re a student, young professional, parent, or retiree, building a budget that adapts to your needs can make all the difference in your financial well-being.

Understand Your Financial Reality

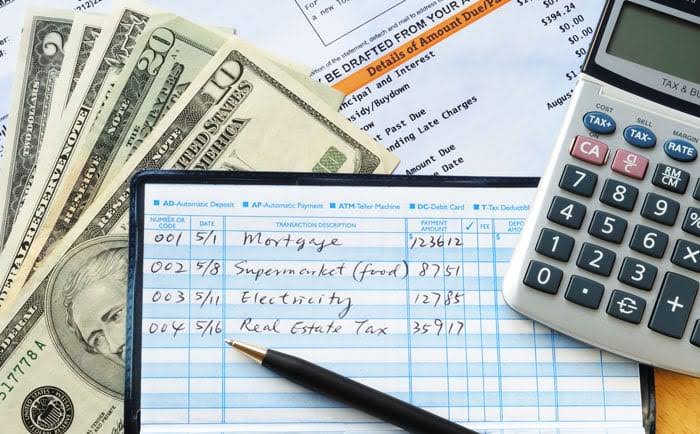

Before creating a realistic budget, you need to assess your current financial situation. This means identifying all your sources of income—salary, freelance gigs, investment returns, government benefits, or any other regular cash flow. Next, take stock of your expenses. These fall into two categories: fixed expenses such as rent, mortgage payments, utilities, and subscriptions, and variable expenses like groceries, fuel, entertainment, and clothing. In July 2025, various budgeting apps offer automatic syncing with bank accounts to make this process seamless, allowing you to categorize spending and identify patterns.

Set Clear Financial Goals

Your budget should reflect your short-term and long-term goals. Are you saving for a vacation, paying off a loan, building an emergency fund, or preparing for a major life event like marriage or moving? Setting financial goals gives your budget direction and purpose. Break these goals into monthly targets to stay motivated. In 2025, goal-setting tools integrated into apps like YNAB, PocketSmith, and Mint allow users to visualize progress and receive alerts when they veer off course. A goal-oriented budget keeps you focused and helps prioritize where your money goes.

Choose a Budgeting Method That Suits You

There is no one-size-fits-all approach to budgeting, which is why choosing a method that matches your lifestyle is essential. The most popular methods include the 50/30/20 rule, zero-based budgeting, and envelope budgeting. The 50/30/20 rule allocates 50% of income to needs, 30% to wants, and 20% to savings or debt repayment. Zero-based budgeting assigns every dollar a job, ensuring that income minus expenses equals zero. Envelope budgeting is more tactile, involving cash in labeled envelopes, but digital apps now simulate this approach for convenience. Evaluate each method and pick one that matches how you spend and save.

Automate What You Can

In today’s tech-driven world, automation is a powerful ally in sticking to a budget. Automate bill payments, savings deposits, and even investments where possible. This ensures you never miss a due date and that your savings goals are funded without relying on discipline alone. Many Canadian banks and fintech apps offer automated transfers to savings accounts, retirement funds, and investment portfolios. Automating essentials not only saves time but also builds consistency—key to financial success in the long run.

Track and Review Your Spending Regularly

A budget is not a static document—it evolves as your life changes. To keep it effective, you must track your expenses regularly and compare them with your planned budget. This helps you identify overspending or any unexpected trends. In 2025, AI-powered apps provide weekly and monthly reports that break down your spending by category, offer personalized insights, and even suggest ways to cut back. Reviewing your budget at least once a month ensures you remain on track and gives you the chance to make necessary adjustments.

Account for Irregular and Seasonal Expenses

A common budgeting mistake is ignoring irregular or seasonal expenses like car repairs, birthdays, holiday gifts, or school fees. These costs might not occur monthly but can derail your budget if unaccounted for. One way to manage this is to create a sinking fund, where you save a small amount monthly for these anticipated events. For example, saving $50 per month for holiday shopping helps ease the burden when December arrives. Many modern budgeting tools now offer features to automatically allocate savings for such categories throughout the year.

Prioritize Emergency Savings

If the pandemic taught us anything, it’s the importance of having a financial safety net. Even in mid-2025, many Canadians and global citizens continue to prioritize building emergency funds. Ideally, you should aim to save three to six months’ worth of living expenses. Start with a small, achievable goal—like $500—and build gradually. Keep this fund in a high-interest savings account that’s easily accessible but separate from your day-to-day spending to avoid temptation. Having this buffer protects you against job loss, medical bills, or other unexpected challenges.

Cut Back Thoughtfully, Not Painfully

Budgeting doesn’t mean sacrificing all joy. Instead, it’s about making intentional choices. Look for areas where small cuts can have a big impact. Maybe you cancel a rarely used subscription, cook more meals at home, or find a more affordable mobile plan. Tools like Canada’s CRTC-supported telecom comparison websites or electricity providers’ cost calculators help identify opportunities to save. The goal is to align your spending with your values, so you still enjoy life without feeling deprived.

Involve Your Family or Partner

If you share financial responsibilities, budgeting should be a collaborative effort. Discuss goals, spending habits, and financial expectations with your partner or family members. Transparency and communication ensure everyone is on the same page, reducing financial stress and disagreements. Many budgeting apps now offer shared access or family budgeting features that allow multiple users to contribute and view budget activity. In 2025, inclusive budgeting is seen not just as a household task but a way to strengthen trust and teamwork.

Celebrate Progress and Stay Flexible

Budgeting is a journey, not a one-time fix. Celebrate small wins—like paying off a credit card or hitting a savings milestone—to keep yourself motivated. Life circumstances will change, and your budget must adapt. Whether it’s a job change, a new baby, or a move to a new city, your financial plan should be flexible enough to accommodate the unexpected. A budget that works for you is one that grows with you—balancing structure with adaptability.

Conclusion

Creating a budget that works in 2025 is both an art and a science. It requires self-awareness, goal setting, the use of modern financial tools, and the discipline to stay consistent. When done right, budgeting empowers you to live within your means, reduce stress, and plan for a future you truly want. Whether you’re aiming to clear debt, build wealth, or simply gain peace of mind, a personalized budget is the foundation upon which all financial success is built.

Interesting